Bank Reconciliations: Everything You Need to Know Bench Accounting

If you use a bank feed or import from bank statement, it’s likely that your bank will have already imported any fees or charges already, so ignore this step. Do you want to test your knowledge about bank reconciliation statement? This is an important fact because it brings out the status of the bank reconciliation statement.

To Ensure One Vote Per Person, Please Include the Following Info

- Knowing how to reconcile bank statements in QuickBooks Online will make the reconciliation process easier and stress free.

- NSF fee for the rejected dishonored check of $10 charged by the bank.

- They can also be used to identify fraud before serious damage occurs and can prevent errors from compounding.

- As you reconcile each transaction, the reconciled balances update at the bottom of the screen.

- All of this can be done by using online accounting software like QuickBooks, but if you are not using accounting software, you can use Excel to record these items.

- To be effective, a bank reconciliation statement should include all transactions that impact a company’s financial accounts.

Remember that transactions that aren’t accounted for in your bank statement won’t be as obvious as bank-only transactions. This is where your accounting software can help you reconcile and keep track of outstanding checks and deposits. Most reconciliation modules allow you to check off outstanding checks and deposits listed on the bank statement.

- Checks which have been written, but have not yet cleared the bank on which they were drawn.

- You can do a bank reconciliation when you receive your statement at the end of the month or using your online banking data.

- A bank reconciliation statement is a valuable internal tool that can affect tax and financial reporting and detect errors and intentional fraud.

- Infrequent reconciliations make it difficult to address problems with fraud or errors when they first arise, as the needed information may not be readily available.

- This can include monthly charges or charges from overdrawing your account.

Bank Reconciliation Statement FAQs

They can also be used to identify fraud before serious damage occurs and can prevent errors from compounding. Bank reconciliation statements are tools companies and accountants use to detect errors, omissions, and fraud in a financial account. Bank reconciliation is a simple and invaluable process to help manage cash flows. Financial statements show the health of a company or entity for a specific period or point in time. Accurate financial statements allow investors to make informed decisions. bank reconciliation The statements give companies clear pictures of their cash flows, which can help with organizational planning and making critical business decisions.

- By avoiding these common errors, you can ensure the accuracy of your organization’s financial records, make informed business decisions, and reduce the risk of financial issues.

- Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank.

- Input all transactions from your bank statement into the spreadsheet.

- This significantly reduces the effort that goes into the reconciliation process and enables businesses to verify their cash balances anytime throughout the month.

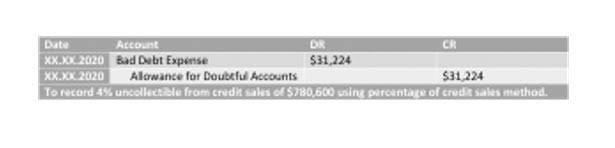

Adjustments to the Cash Account

Statement date – The end date of the bank statement you are reconciling. Even their chart of accounts is a nightmare („Due to XXXXXX“ being an other current liability as well as an expense) Im going to consult an accountant and see what they have to say. A good starting point may be to look for ‘Forced Reconciliation’ entries, where whoever handled it before forced the books to reconcile despite discrepancies.

Step 1. Choose Your Method for Reconciliation

After all reconciliation adjustments, the final correct cash balance captured in the company accounting records and on its balance sheet as at 30 September 20XX was $2,000. The final balance on the bank reconciliation statement, after all corrections and adjustments, is the actual “true” https://www.bookstime.com/articles/estimated-tax cash balance reported in the company’s balance sheet. The reconciled and adjusted cash book balance is reported in a company’s financial statements.

Fact Checked

Regular bank reconciliation saves you from having to review a full year of financial records—instead, you can quickly consult your reconciliation statements to review any required information. Bank reconciliation isn’t just important for maintaining accurate business finances—it also ensures your customer and business relationships remain strong. Regular bank reconciliation double-checks that all payments have been accurately processed. This includes payments by customers to your company and payments from your company to employees, contractors, and other goods and services providers. If everything matches, the total of all reconciled transactions added to the starting balance will match the closing balance. If the discrepancy persists, review both your internal records and bank statements closely.

It’s just money taken out/put in, and the Retained Earnings rolling over from year to year… (c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book. Similarly, if a businessman deposits any checks on the last day of the month, these cheques may be collected by his bank and shown on his bank statement three or four days later.

- Compare your personal transaction records to your most recent bank statement.

- Starting with an incorrect opening balance can lead to errors in the reconciliation process.

- If you use accounting software, then your reconciliation is done largely for you.

- Where there are discrepancies, companies can identify and correct the source of errors.

- The discrepancies between the two could be due to many reasons, including errors you’ve made while entering an amount, duplicate entries, a payment that’s yet to clear, or even bank interests and fees.

- Therefore, an overdraft balance is treated as a negative figure on the bank reconciliation statement.

- This is also known as an unfavorable balance as per the cash book or an unfavorable balance as per the passbook.

It’s essential to ensure that the starting balance is accurate before beginning the reconciliation process. Next, prepare the business records, which can be maintained on a software tool or manually on a spreadsheet. Compare the balance sheet’s ending balance with the bank statement’s ending balance. The first step is to obtain a detailed statement from the bank, which includes information about checks cleared and rejected by the bank, transaction charges, Accounting Periods and Methods and bank fees. Bank reconciliation is a subset of the monthly, quarterly, and yearly close process and is not generally done on its own. Accountants spend a lot of time on this step to ensure the checks are thorough and even minute errors are spotted.

However, if there are discrepancies between this communication and the official plan documents, the plan documents will always govern. Bank of America retains the discretion to interpret the terms or language used in any of its communications according to the provisions contained in the plan documents. Bank of America also reserves the right to amend or terminate any benefit plan in its sole discretion at any time for any reason. You can unreconcile transactions when you save the reconciliation as a draft.